In a symbolic changing of the guard, Nvidia replaced Intel in the Dow Jones Industrial Average last November, marking the end of an era in American technology. For decades, Intel was synonymous with computing power, its "Intel Inside" stickers adorning millions of computers worldwide. Today, the company's market capitalization stands below $100 billion, while Nvidia—riding the artificial intelligence wave—commands a valuation exceeding $3 trillion.

Yet, amidst this dramatic reversal of fortune lies an intriguing possibility: Intel could emerge as America's most strategically important technology company by 2030—if it can survive the next five years.

SPONSORED CONTENT: Gain 1 hour back every day with an AI executive assistant: Fyxer AI

Gain 1 hour back every day with an AI executive assistant: Fyxer AI

Fyxer AI automates daily email and meeting tasks, saving users up to 60 minutes a day.

Prioritizes important emails, ensuring high-value messages are addressed quickly.

Automatically drafts email responses in your tone of voice. It's so accurate that 63% of emails are sent without edits.

Listens to your video calls and sends a meeting summary with clear next steps.

The Fall of a Silicon Valley Icon

Intel's troubles came to a head last October when it reported a staggering $16.6 billion quarterly loss—the largest in its 56-year history. This financial calamity was compounded by a 60% stock price collapse since Pat Gelsinger assumed the CEO role in February 2021, culminating in his forced departure in December.

"The burn rate became simply unsustainable," says a senior semiconductor analyst who requested anonymity. "Intel was spending billions on new fabs and R&D while its cash-generating businesses faced intense competitive pressure from all sides. It became a race against time that Gelsinger ultimately lost."

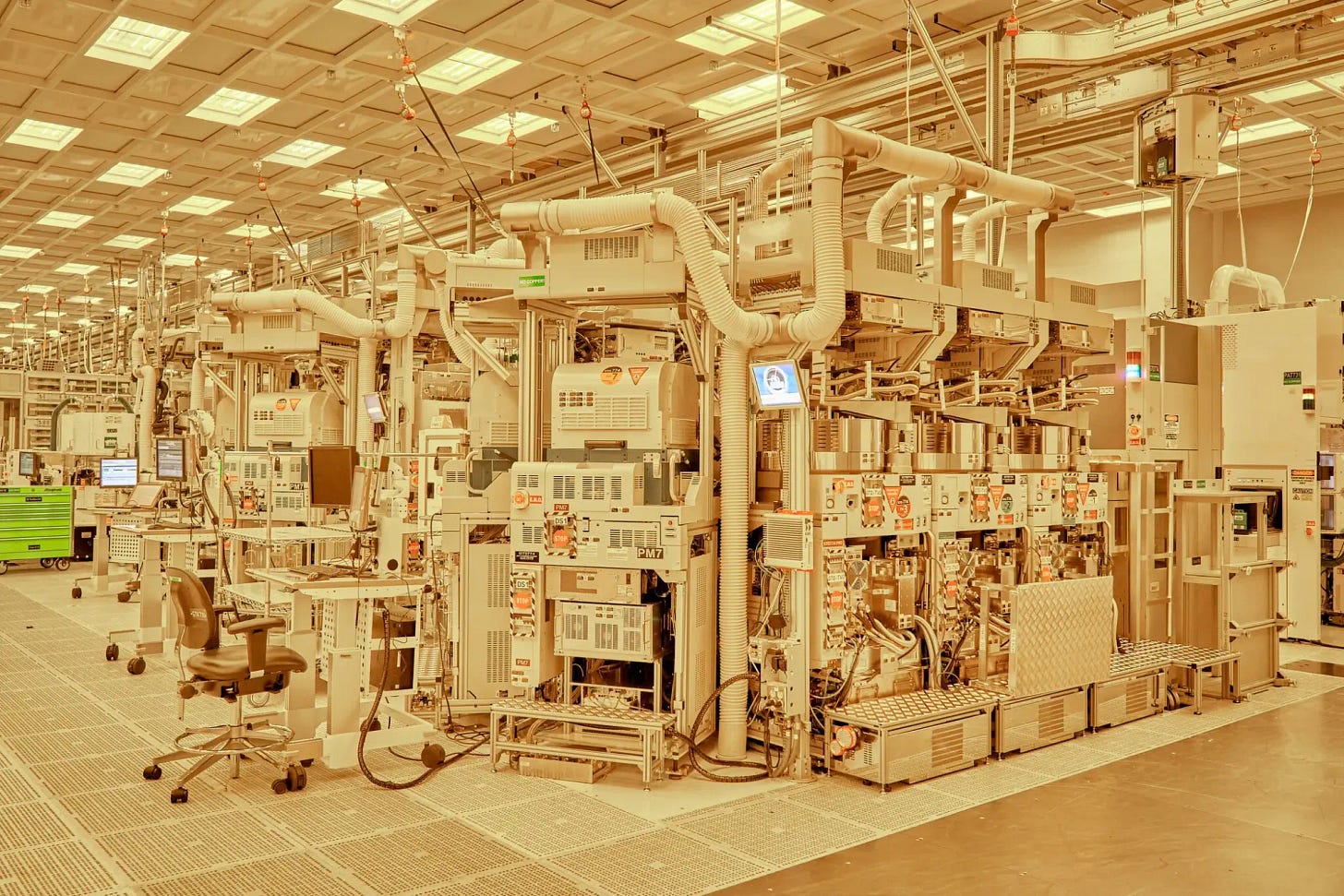

The company's manufacturing difficulties have been particularly damaging. While Intel once led the industry in process technology, it has fallen significantly behind Taiwan Semiconductor Manufacturing Company (TSMC). According to an industry official briefed on Intel's progress, its most advanced processes are yielding functional chips at rates below 10%, compared to TSMC's 30% for comparable technology.

"The yield gap is devastating to Intel's economics," explains a veteran semiconductor equipment executive. "At those rates, manufacturing costs become prohibitive regardless of government subsidies."